Coachella Valley Real Estate Market Update - June 2024

As summer heats up, the Coachella Valley real estate market shows some intriguing trends. Here’s a detailed look at how single-family homes and condos are performing and what it means for buyers and sellers.

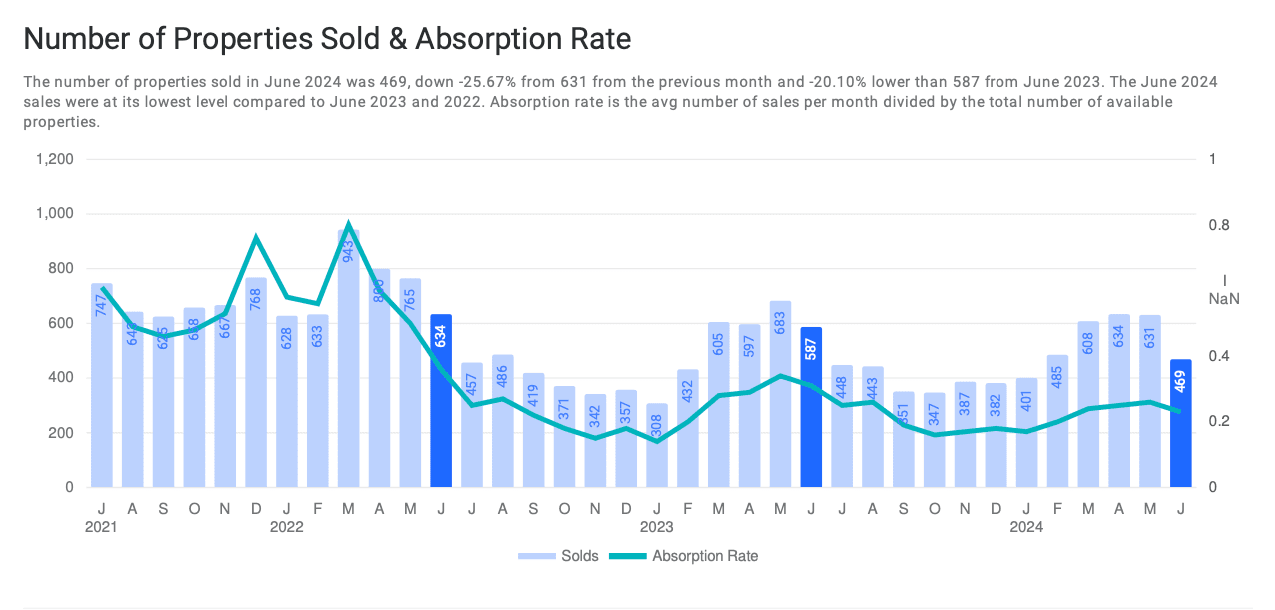

Valley Wide Market Overview

Single Family Homes

The single-family home market in the Coachella Valley is showing a median sales price of $938,485, down by 9%. This decline signals to sellers the importance of competitive pricing to attract buyers who are increasingly seeking value. With homes selling at 97.53% of their listing price, realistic pricing is crucial for a successful sale. The average number of homes sold has decreased by 23% to 47 per city, giving buyers an upper hand with more choices and potentially better deals however combined with an average 97% list to sales price seller are still able to obtain their asking price when listed at an appropriate price point. The absorption rate of 23% combined with an increase in average DOM to 69 days (+12%) indicates that homes are staying on the market longer, providing buyers with more time to negotiate favorable terms. With 204 active listings per city and 502 new listing valley wide, the market is ripe with opportunities for both buyers and sellers to achieve their real estate goals.

Condos

In the condo market, the median sales price has surged by 26% to $598,929, reflecting strong demand. Condos are selling at 96.14% of the list price, emphasizing the need for realistic pricing in all market segments, and buyers should expect to offer close to the list price. The average number of condos sold per city has dropped by 32% to 20 units, suggesting inventory constraints and a need for buyers to act quickly. The absorption rate stands at 22%, indicating a steady pace in the market, while the average DOM is 86 days, a slight increase of 11%, pointing to extended negotiation periods. The price per square foot is $405, offering a more affordable entry point compared to single-family homes. With an average active inventory of 105 condos and 232 new listings across the valley, buyers have more options to consider.

Market Momentum

The Coachella Valley real estate market is showing stability with some minor adjustments, reflecting a nuanced landscape for both single-family homes and condos. Single-family homes are maintaining their value, though they are taking longer to sell. This extended time on the market indicates that buyers have more opportunities to explore their options and negotiate favorable deals, while sellers may need to adopt more strategic marketing approaches to attract potential buyers.

In contrast, the condo market is experiencing a notable increase in prices despite a drop in sales volumes. This trend suggests that condos are in high demand, and buyers are willing to pay a premium for desirable properties. However, the lower number of transactions points to possible inventory constraints, meaning there are fewer properties available for buyers to choose from.

Overall, the market’s momentum is balanced, with neither buyers nor sellers having a distinct advantage. This equilibrium is seen in the near-alignment of sales prices with listing prices, indicating that both markets are achieving close to their asking prices. The steady absorption rates for both single-family homes and condos reflect a healthy turnover of properties and consistent buyer interest.

Pricing Strategies

For sellers, it’s crucial to set competitive and realistic prices to attract buyers, as overpricing can result in longer time on the market. In today’s market, buyers are more informed and have access to a wealth of data, allowing them to compare properties easily. Thus, pricing a property too high can deter potential buyers who may find better value elsewhere. Sellers should conduct thorough market research and possibly seek professional appraisals to ensure their listing price reflects current market conditions and comparable sales in the area.

Highlighting unique features and the quality of properties can justify higher prices, especially in a market where buyers are showing strong interest in premium properties. Sellers should focus on showcasing the aspects of their home that add value, such as modern renovations, energy-efficient appliances, or desirable locations. Professional staging and high-quality photography can also play a significant role in attracting buyers and justifying a higher asking price. Additionally, providing detailed property descriptions and highlighting any unique selling points can help differentiate a home from others on the market.

Buyers, on the other hand, should be prepared to offer close to the list price, particularly in the condo market where demand is driving up prices. In such a competitive environment, lowball offers are less likely to be successful. Buyers should work closely with their real estate agents to understand the fair market value of properties and be ready to make strong offers that reflect the property’s worth and the current market dynamics. Being pre-approved for a mortgage can also give buyers an edge, as it demonstrates financial readiness and commitment to the purchase.

City By City June 2024

Palm Springs

In Palm Springs, the median sales price for single-family homes in June 2024 is $1,112,500, reflecting a notable increase from the previous month’s $999,475. The average sales price has also risen to $1,300,604, indicating a robust demand for higher-end properties. Homes are selling at 97.31% of their listing price, suggesting strong buyer interest and realistic pricing by sellers. The number of homes sold in June 2024 is 28, down from 40 in May, showing a decrease in market activity. The absorption rate has decreased to 10%, with the average days on market (DOM) increasing to 85 days, suggesting homes are taking longer to sell. The price per square foot has risen to $619, indicating an increase in property values. The active inventory has grown to 280 homes, with 78 new listings in June, providing more options for buyers.

For condos, the median sales price in June 2024 is $1,175,000, significantly higher than May’s $388,300, showing a strong month-to-month increase. The average sales price for condos is $1,297,134, with a sales to list price ratio of 97.33%. The condo market saw 29 sales in June, down from 67 in May, while the price per square foot increased to $621, reflecting higher property values.

Cathedral City

Cathedral City’s real estate market reveals a dynamic shift. The median sales price for single-family homes has risen to $544,000 from $532,000 in May, indicating steady price growth. The average sales price is up to $559,742, reflecting increasing property values. Single-family homes are selling at 98.97% of their listing price, suggesting strong buyer interest. However, sales volume has dipped slightly, with 30 homes sold in June compared to 33 in May. Homes are taking longer to sell, with the average days on market (DOM) increasing to 49 days. The price per square foot remains stable at $330, and the active inventory stands at 114 homes, with 42 new listings.

The condo market also shows significant changes. The median sales price has jumped to $350,000 from $290,000 in May, showing strong demand. The average sales price for condos has increased to $361,190. Condos are selling at 97.47% of their listing price, indicating buyers are paying close to asking prices. Sales volume is slightly down, with 10 condos sold in June compared to 11 in May. Condos are taking longer to sell, with an average DOM of 94 days. The price per square foot has increased to $284, with 31 active listings and 12 new ones. Overall, Cathedral City’s market is experiencing robust price growth amid slightly longer selling times.

Rancho Mirage

I

The absorption rate for single-family homes is at 17%, with an average days on market (DOM) of 60 days, suggesting that homes are taking about two months to sell, consistent with the previous month. The price per square foot for these homes is $438, indicating a decrease in property values. Active inventory stands at 162 homes, with 72 new listings in June, providing a substantial selection for potential buyers.

Turning to the condo market, the median sales price in June 2024 is $625,000, down from $680,000 in May, continuing the cooling trend. The average sales price has also decreased to $589,567. Despite the price drops, condos are selling at 97.79% of their listing price, indicating that buyers are still willing to pay close to the asking price. The number of condos sold in June is 15, up slightly from 14 in May, showing stable sales activity. The absorption rate for condos is 18%, with an average DOM of 118 days, indicating that condos are taking longer to sell.

Overall, Rancho Mirage’s real estate market in June 2024 reflects a decrease in prices for both single-family homes and condos, with stable sales activity for condos but a notable drop in single-family home sales. This evolving market requires both buyers and sellers to stay informed and adaptable to navigate these changes effectively.

Palm Desert

In June 2024, single-family homes maintain a median sales price of $660,000, unchanged from May, signaling a balanced market. The average sales price has risen to $1,000,795, showing strong demand for high-end properties. Despite this, sales activity has slowed, with 74 homes sold compared to 91 in May. Homes are selling at 98.34% of their listing price, reflecting realistic pricing by sellers. The average days on market (DOM) is steady at 60 days, indicating a healthy selling period.

In the condo market, a slight cooling is evident. The median sales price dropped to $480,000 from $521,000 in May, and the average sales price decreased to $499,522. Condos are selling at 96.34% of their listing price, suggesting sellers need to be more flexible. Sales volume has decreased, with 60 condos sold in June compared to 71 in May. The average DOM for condos increased slightly to 61 days, offering buyers more time to decide. Overall, Palm Desert shows stable single-family home prices and a cooling condo market, providing opportunities and challenges for both buyers and sellers.

Indian Wells

In Indian Wells, the real estate market in June 2024 displays a mix of significant price changes and decreased sales volume. The median sales price for single-family homes is down from $2,274,500 in May 2024 to $1,765,000 in June 2024. The average sales price for these homes is now $2,058,955, reflecting strong demand for Indian Wells’ luxury properties. However, homes are selling at 96.61% of their listing price, suggesting sellers might need to adjust their expectations slightly. The number of single-family homes sold has decreased to 11 from 16 in May, indicating a slowdown in market activity. The absorption rate stands at 27%, with the average days on market (DOM) decreasing to 72 days, suggesting quicker sales compared to the previous month. The price per square foot is $523, showing a decrease in property values. Active inventory is at 41 homes, with 12 new listings in June, providing limited options for buyers.

For condos, the median sales price in June 2024 is $712,500, down from $895,000 in May, indicating a cooling trend overall in Indian Wells. The average sales price for condos has also decreased to $1,341,140. Condos are selling at 91.72% of their listing price, showing a need for more realistic pricing by sellers. The number of condos sold in June is 5, a significant drop from 15 in May, reflecting a sharp decline in sales volume. The absorption rate for condos is 14%, with an average DOM of 77 days, indicating longer selling periods. The price per square foot for condos is $575, with active inventory at 35 and 7 new listings in June. Overall, Indian Wells shows a high demand for luxury single-family homes despite decreased sales, while the condo market is experiencing both price and sales volume declines.

La Quinta

In La Quinta, the median sales price for single-family homes is $749,995, down from $925,650 in May 2024 and $815,000 in June 2023, indicating a cooling trend in the market. The average sales price has decreased to $992,185, reflecting similar downward pressure. Despite the price drop, homes are selling at 97.36% of their listing price, suggesting that sellers are still achieving close to their asking prices. The number of single-family homes sold in June is 72, down from 107 in May, showing a significant decrease in sales volume.

The absorption rate stands at 25%, and the average days on market (DOM) is 78 days, indicating that homes are taking longer to sell. The price per square foot has decreased to $383, reflecting a decline in property values. Active inventory is at 293 homes, with 106 new listings in June, providing a good selection for buyers.

In the condo market, the median sales price in June 2024 is $547,500, slightly down from $550,000 in May, indicating stable pricing. The average sales price for condos has also decreased to $649,312. Condos are selling at 96.56% of their listing price, showing that sellers may need to adjust their pricing expectations. The number of condos sold in June is 16, down from 31 in May, reflecting a sharp decline in sales volume. The absorption rate for condos is 34%, with an average DOM of 149 days, indicating that condos are taking significantly longer to sell.

The price per square foot for condos is $405, with active inventory at 47 and 20 new listings in June. Overall, La Quinta’s real estate market in June 2024 is characterized by decreasing prices and sales volume, with extended selling times, suggesting a more challenging environment for sellers and more opportunities for buyers.

Indio

In Indio, the real estate market for June 2024 presents a picture of mixed trends with both challenges and opportunities. For single-family homes, the median sales price has increased to $567,900, up from $559,995 in May 2024, showing a slight month-to-month growth. The average sales price is $640,046, indicating a healthy demand for these properties. Single-family homes are selling at 98.03% of their listing price, suggesting sellers are receiving offers close to their asking prices. However, the number of homes sold has decreased to 84 from 88 in May, indicating a slight drop in sales volume. The absorption rate is at 29%, and the average days on market (DOM) has increased to 71 days, suggesting homes are taking longer to sell. The price per square foot is $299, reflecting stable property values. Active inventory stands at 349 homes, with 108 new listings in June, providing a broad selection for buyers.

In the condo market, the median sales price in June 2024 is $302,500, slightly down from $315,000 in May, indicating a minor cooling. The average sales price for condos is $301,000, also showing a slight decrease. Condos are selling at 95.8% of their listing price, suggesting sellers might need to adjust their pricing strategies. The number of condos sold has decreased to 4 from 6 in May, reflecting a drop in sales volume. The absorption rate for condos is 19%, with an average DOM of 20 days, indicating a faster turnover compared to single-family homes. The price per square foot for condos is $300, with active inventory at 21 and 6 new listings in June. Overall, Indio’s real estate market in June 2024 is characterized by stable single-family home prices with slightly longer selling times, while the condo market shows minor price decreases and quicker sales.

Overview

The Coachella Valley real estate market in June 2024 presents a dynamic landscape with unique opportunities and challenges for both buyers and sellers. Single-family homes are experiencing a price correction, making competitive pricing essential for sellers while providing buyers with more negotiating power. Despite the slowdown in sales volume, homes that are priced realistically are still selling close to their listing prices. The condo market, on the other hand, is witnessing strong price growth amidst inventory constraints, requiring buyers to act swiftly and be prepared to offer near the asking price.

Overall, the market remains balanced, with neither buyers nor sellers holding a significant advantage. Whether you are looking to buy or sell, staying informed about these trends and understanding the nuances of the current market will be crucial in making strategic decisions. As the market evolves, adaptability and realistic expectations will be key to achieving your real estate goals in the Coachella Valley.